During the last six years, Cluj-Napoca’s custom software development market has grown into one of Europe’s new popular tech destinations. This specific custom software development market entered with big wings in 2020, and we are expecting to see an important downturn due to the epidemic outbreak. With a 29% year-on-year market growth rate recorded in 2018 and an estimated similar growth rate for 2019, the particular custom software development market from Cluj-Napoca is employing as an annual average +16000 software engineers. Before the release of Q1/2020 factsheets, it is important to understand how Cluj-Napoca custom software development market looked at the end of December 2019.

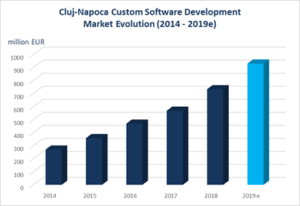

2014 – 2019 Cluj Custom Software Development Market Evolution

By December 2019, a number of 1330 companies declared to have as main business activity: custom software development. Analyzing this pool of companies, we realized that a staggering 58.50 % of the total custom software development companies were created between 2015 – 2019. Nevertheless this new wave of tech companies, employs only 12.21% of the active custom software development workforce, while the oldest group of companies – those founded before year 2000 and representing 2.86% of the local market employs 32.08% of of the active custom software development workforce.

In other words, the backbone of Cluj-Napoca custom software development market is the biggest employer on the market, and has gone through many stages of the global software market and through several economic crisis.

Based on the positive economical trends in Romania and implicitly Cluj-Napoca, the local IT ecosystem favored entrepreneurship and investment in custom software development. The emergence of 798 software development companies during 2014 and 2019 (among which we can count also a few big development center relocations from Western Europe), has contributed to the constant growth of the total market turnover. As you can see in the chart, this segment grew from 269,89 million Euros in 2014 to an estimated 930,99 million Euros in December 2019.

The market y-o-y growth rates vary across the period, with a boost of 34% in 2015, and again an estimated growth of 30% in 2019 compared to 2018 due to the active promotion of Cluj-Napoca as a tech talent pool and cool professional life style destination.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 e |

| Growth rate (y-o-y) | – | 34.00% | 31.00% | 24.00% | 29.00% | 30.00% |

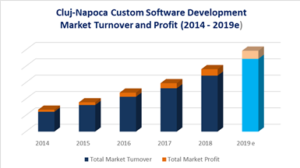

The Profit Margin Remains Steady For Cluj Based Custom Software Development Companies

The profit margins recorded on Cluj-Napoca custom software development marked improved over the studied period (2014 – 2019e), varying between 10% and 11% The peak of 11.78% profit margin was reached in 2016.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019e |

| Market Profit Margin (%) | 10.26 | 10.30 | 11.78 | 11.76 | 11.46 | 11.11 |

Analyzing the local custom software development market’s turnover and the weight of profit margin, we can observe that in spite of turnover growth, the profits remained around the same percentage.

This translates into two market facts:

- Cluj-Napoca custom software development market is acting as a nearshore/offshore development center for US and Western Europe software companies.

- The financial performance of Cluj custom software companies improve slowly as they try to change their approach to the global market.

The Software Developers Employees Pool Flies in Tandem With Cluj IT Graduates Base

Based on the annual average employee declarations at the National Agency of Fiscal Administration, the total employee number almost doubled from 2014 to 2018. This is also a consequence of the many new custom software development companies founded or established in Cluj in the studied period. From a declared annual average number of 8325 programmers in 2014, Cluj custom software development market counted 15698 annual average employee number in 2018 to which we should also add freelancers and entrepreneurs.

The key observation on this data set is that the year-on-year growth in 2015 – 2016 was of 20%, and declined to 14% for the fiscal years 2017 and 2018, and is likely to be even lower for 2019.

Why? The phenomenon is mainly due to the fact that tech companies from Cluj are recruiting from the same university IT graduate base. And the speed of developing a new generation of software developers is not the same as the speed of setting up new software companies and centers in Cluj-Napoca.

The Key Questions For 2020

- How will Cluj-Napoca custom software development companies handle the effects of the global pandemic?

- Will the young horses of Cluj-Napoca software development market resist in the new context?

- What companies have the right stamina an financial reserves to successfully navigate across 2020?

In order to find out the answer, we will be monitoring the new data sets available on the market and come back with more information.

Meanwhile, if you have questions and are interested in understanding more about Cluj-Napoca custom software development market, you are welcome to contact both our market research and software development teams.

—–